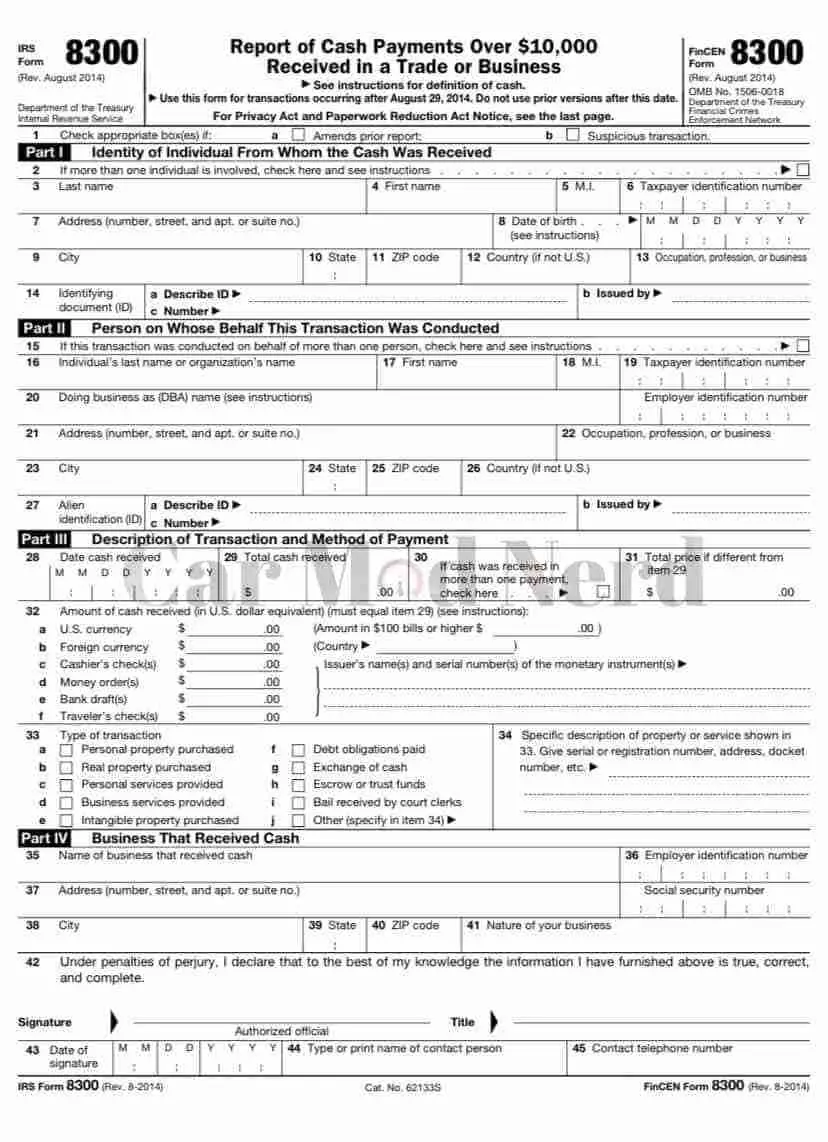

Why Is It Suspicious To Buy A Car With Cash? It is suspicious to buy a car with cash. A cash transaction is typically more difficult to track than a credit card payment, for this reason it is seen as more suspicious. When purchasing a car with cash, the seller may not be able to prove the title is clear and the car is free from liens or other encumbrances. It is better to have a proof of your source of income, particularly if it is unusually large and don’t forget to file 8300 IRS form if the transaction exceed $10,000.

There’s only about 26% of car buyers pay in cash. Imagine this; You’re window-shopping at a dealership. A man walks in with a briefcase full of money and makes an outright payment for an expensive car. How will you react? And you are not even the dealer! Why not save the trouble and rent a car instead?

What If I tell you can buy a brand new car for half price. Unbelievable? Read my post on how to buy a loaner car and clear your doubts.

Is It Suspicious To Buy A Car With Cash

There is nothing illegal about large cash deposits. However, this can arouse suspicion. There are a lot of legitimate reasons to be suspicious of huge cash deposits. It can be a scammer or someone money laundering.

- Prevalence of Fake Currency

- Possible Illegal or Criminal activities

- Money Laundering

Prevalence of Fake Currency

Physical cash deposits can make the dealer nervous or uneasy about the source of the money. The ever-increasing rate of dishonesty and brazenness pushes people into many inhumane actions. One of which is paying in fake currency.

Many scammer have stepped up their game. They now make very convincing fake currencies. Some even go as far as mixing fake money with original ones to confuse while making payments.

Money Laundering

Money laundering is a method of making illegally obtained money appear as if it came from a legitimate source, so that the funds cannot be connected with criminal activity. Income from criminal activities is typically placed into financial institutions without revealing the underlying source.

Someone may try to launder their black money through buying luxury cars.

Illegal or Criminal Activities

The dealer might also feel uneasy if they suspect the client to be a human or drug trafficker, money laundering, or some other criminal activity.

Although the basis for these suspicions is justified, many logical facts refute this argument. Large amounts of money are not always made illegally. And dealer must file a suspicious activity report to avoid scam.

Here’s my detailed Ricer Car Definition for you.

How To Avoid Raising Suspicion When Buying a Car With Cash

If you want to buy a car with physical cash, there are a few ways to avoid raising suspicion of the dealer. Thanks to the $10,000 rule created by the Bank Secrecy Act, dealers can report suspicious transactions to the IRS without causing unnecessary drama.

This law states that; any individual or business receiving more than $10,000 in single or multiple cash transactions must report this to the IRS (Internal Revenue Service) using form 8300.

Do not be reluctant to allow the dealership to file this form. This will make them less suspicious.

Once the report has been filed, the IRS will inform local, state and even national officials to track where the money is going and came from. The IRS lists specific situations when you need to file a Form 8300.

Should this scare you? Of course not. Only a wicked man runs when he is not being pursued. This means you shouldn’t be apprehensive about making large deposits if the source is legit.

You can always rent a car from the best providers and save the hassle.

Why Don’t Dealerships Let You Buy A Car With Debit Or Credit Card

Some dealerships accept payment with a debit or credit card. Most dealerships do not. This is due to several reasons.

- Wait Time

- Transaction Charges

- 90-day Full Refund Return Policy

Wait Time

They may have to wait for the transaction to process before they get the money in their bank account. This often takes between one and three days and discourages many dealerships.

Transaction Charges

The biggest turn-of for any dealer is that he has to pay up to 5% (depending on the amount) of the transaction to process your card payment. Picture this, a car worth about $50,000 will cost the car dealership an extra $2500 when you pay with a card. Do you think anyone will like that?

90-day Full Refund Return Policy

Another reason why car dealership avoid credit and debit card is because of the rights customers get. You can return any purchase made with a credit card for a full refund within 90days of purchase. Even though a few principles and conditions are guiding this right of a customer, the dealer is still a loss. If a customer initiates a chargeback, the transaction will be reversed and they won’t receive payment.

What Can You Do To Stay Safe When Selling A Car For Cash

Are you a car dealer or private seller? You’re probably wondering how you can sell a car for cash? Well, here are some steps to ensure the safety of both you and the potential buyer. I strongly recommend using an escrow service for selling cars online.

For Buyer’s Safety

- Ensure all transactions are properly documented. Have a record of transactions carried out and ensure that each transaction is properly recorded with the appropriate date. Always have a software backup for your physical records. You can always refer to this record if the need arises.

- Do not disclose personal information about cash buyers or potential cash buyers.

For Seller’s Safety

- Proper record is not just beneficial for the cash buyer only. It can also protect you when the need arises.

- When a buyer makes a cash deposit above $10,000, ensure you file a Form 8300 for the IRS. This helps the authorities to track the cash you receive and verify its authenticity.

- Private sellers must always meet buyers in a public place. Some suspicious cash buyer may request you to meet them in an unknown location. This is a big red flag.

- Storing up cash at your business place or carrying it around can be dangerous. As soon as you receive the cash payments, make prompt arrangements to deposit the money in the bank immediately.

- If you receive complaints from your bank, inform the vehicle buyer immediately.

So, how do I buy a car with cash?

How To Buy A Car With Cash

The most straightforward way to pay for anything is with cash. You don’t have to worry about monthly payments, financing, loan term, interest rate as with a credit card. This means you spend less money.

There are a few downsides of bypassing financial institution and other forms of monetary instrument than cash. Here’s a straightforward step-by-step guide on how to purchase a car with cash without worrying about car loan.

The first thing you need to do is to identify the car you want. Draw up a budget and then save up to meet this budget to avoid cutting a coat way too big for you.

- Identify A Reputable Dealer

- Effective Negotiation

- Evidence Of Payment

Identify A Reputable Dealer

You can’t just waltz into any dealer shop you find on the roadside to purchase something as valuable as a car. Proper investigation will help you find a reliable and reputable dealer to buy from.

If they have a website, check the website for customer reviews and other information to help you rate the quality of their services. Ask around for recommendations.

Effective Negotiation

Congratulations! You saved up for your dream car. Now, this Doesn’t mean that you have to spend every penny you saved to purchase the car. You need to arrive at a good price.

At this point, you need the haggling skills of a defiant African woman. The best way to do this is to arm yourself with knowledge.

Read several car ranking reviews and buying insights. They provide information on the best dealerships to buy from and the best time to shop for a car. This will give you an upper hand.

Window shopping from many car dealers will give you an idea of the average price of the car you wish to purchase. Never let the dealer know how much you have at hand until you have agreed on a price.

Feel free to use your power to walk away from a bad deal. Keep trying till you find the right dealer and arrive at a convenient price.

Evidence Of Payment

By now, you have already agreed on a price. Now you can pay.

After the transaction has been finalized, any reputable dealership must give you a receipt as payment evidence.

This will save you from future drama when there is a problem with the car.

The most important document you should get is the bill of sale. It is also called the sales agreement document. This document proves that the transaction occurred and after sales information.

The proof of ownership document proves your new ownership of the car. It contains some vital information such as the year and make of the car, the VIN, and other information.

The receipt is not very important once you have these other documents but It is necessary.

Ensure your dealer submits IRS form 8300 if you are paying cash over $10,000.

What Are The Penalties If A Dealership Does Not File A Form 8300

Transactions over $10000 require a dealership to file a form 8300. This form provides the government with an audit trail to investigate possible criminal activities such as tax evasion or money laundering.

When a dealership fails to file a form 8300 for these types of transactions, then they can be charged with non-compliance. This renders civil forfeiture or even criminal penalties depending on the case.

Civil Penalties For Not Filing IRS Form 8300

- Failure to file a form or include all necessary information due to negligence has a penalty of $280 per return. The highest amount should not exceed $3,392,000 per year.

- Persons with an average yearly gross income of $5,000,000 and below, have a ceiling penalty of $1,130,500 for each calendar year.

- If the dealership corrects this error before 31 days after the initial filing date required, then the penalty is reduced to $50 per return. This brings the maximum amount enforced in a year to $565,000.

- If a dealership intentionally disregards the requirement to file or include correct information, the penalty ranges from $28,260-$113,000 per error. Depending on the annual income.

- A timely and complete notice needs to be sent to the required person to be identified on the form. Negligent failure to deliver this notice attracts a penalty of $280 per statement.

- If this failure to deliver a notice is corrected in 30 days, the penalty is reduced to $30 instead of $100 and the ceiling is $250,000. For people with a gross income of $5,000,000 or below, the maximum charge is $75,000.

Criminal Penalties For Not Filing IRS Form 8300

- A person who willfully refuses to file a Form 8300 with credible and complete information is subject to Criminal sanctions. Such a person may be charged with a felony. This sanction includes a fine 0f $25,000 or a prison sentence of up to 5 years.

- Anyone who purposely files a false form can be fined up to $100,000 or a prison sentence of up to 3 years.

Buying Car With Cash And Form 8300 FAQ

For me, there is no “best way” to make payments for a car. Every method of payment has its pros and cons. Is it suspicious to buy a car with cash? Cash payments are not illegal, just suspicious. If your source of income is legitimate, you do not have to worry about the suspicion.

Car dealers also do not need to be afraid to accept cash payments. The IRS has put several measures in place to protect you from fraud, such as Form 8300. When next you need to buy a car, weigh your options properly to choose which method of payment best suits you.

You are buying but how much the car salesmen are making of it? Read here.